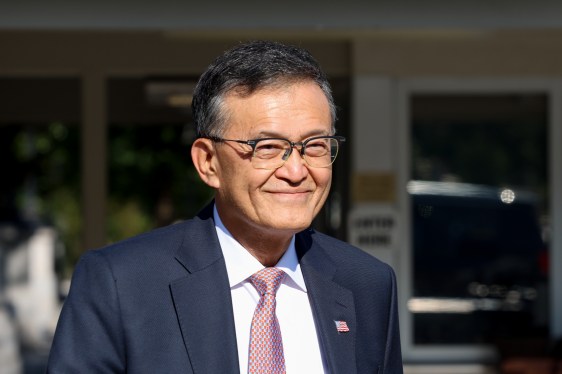

Intel reported third-quarter earnings that surpassed Wall Street expectations. The results were strengthened by an increase in revenue combined with significant cost reductions and multiple large investments over the past two months. Under CEO Lip-Bu Tan, the company is working to turn around its fortunes.

The company’s revenue and its four point one billion dollars in net income present a much more positive picture than its previous string of quarterly losses. However, the recovery story includes extensive cost cutting through layoffs and other reductions, as well as a series of high-profile investments from SoftBank, Nvidia, and the U.S. government.

Intel added twenty billion dollars to its balance sheet during the third quarter, as announced in its earnings presentation. This news caused the company’s stock to rise significantly. The growth was largely due to three major investments received over the last three months.

In August, SoftBank invested two billion dollars. A few days later, the U.S. Government took an unprecedented ten percent equity stake in Intel. The company has so far received five point seven billion of the planned eight point nine billion dollars from the government. In September, Nvidia also bought a five billion dollar stake in Intel as part of a broader deal to jointly develop chips over time.

The company also received five point two billion dollars from closing the sale of its ownership stake in Altera, a hardware company it had owned since 2015, on September twelfth. It also sold its stake in Mobileye, an autonomous driving technology company.

Intel grew its quarterly revenue by eight hundred million dollars in the third quarter to thirteen point seven billion dollars, compared to twelve point nine billion dollars in the previous period. Intel reported net income of four point one billion dollars for the quarter, a sharp reversal from the sixteen point six billion dollar loss it reported in the same period last year.

Despite the strong quarter, there were few details on the future of Intel’s foundry business, which makes custom chips for clients. This business has struggled from the start and has been a focus for Tan, who initiated significant layoffs in the foundry division this summer.

The foundry business appears to be a priority for the Trump administration. A key condition of the government’s investment includes language that will penalize Intel if it divests from its foundry business over the next five years.

Wall Street is closely watching the foundry unit for signs of the company’s long-term growth. Analysts previously stated that Intel did not need cash to turn itself around but rather a strategy to get its foundry business on track.

Tan said that Intel believes its foundry business is uniquely positioned to capitalize on the growing demand for chips. However, he provided few details beyond stating that the company is actively engaging with potential foundry customers. He added that the growth of the foundry business would remain disciplined, emphasizing that building a world-class foundry is a long-term effort founded on trust and the ability to meet diverse customer needs.