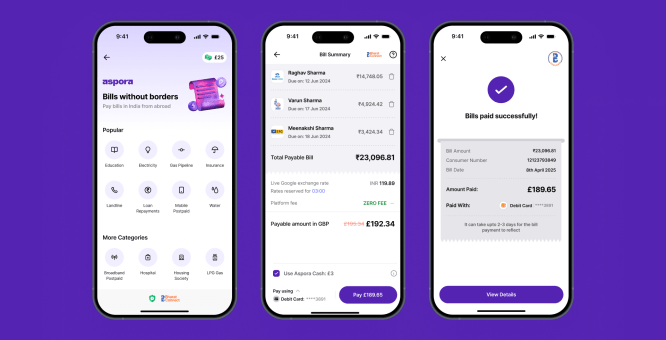

Aspora, a fintech platform backed by Sequoia, is launching a new feature that allows users to pay bills. This service enables non-resident Indians to pay utility bills or recharge mobile prepaid plans for their family members in India.

Previously, users had to transfer money to their Indian accounts or ask someone else to handle the bills. The other option was to use foreign cards, which often resulted in high charges and frequent payment failures.

The startup has integrated with the Bharat Bill Payment System, which handles bill payments in India, through Yes Bank’s domestic pipeline. This connection allows for payments to over 22,000 billers. These billers include electricity providers like BSES and BESCOM, broadband providers such as Jio and Airtel, and loan payments for major banks.

Aspora is not charging any fees for these payments, and users get the best exchange rates to pay their bills directly in foreign currency.

The founder and CEO, Parth Garg, stated that paying bills in India has always been unnecessarily complex for millions of Indians living overseas. He explained that the process involved transfers, delays, and double fees. Aspora has now solved this large-scale problem with the tap of a button.

Garg believes that while bill payments might reduce the total volume of remittances, the reduction will only be about four to five percent. He thinks giving users the ability to pay bills will create long-term loyalty.

He mentioned that the goal for any neobank is to increase transactions on its app. With only remittances, people used the app once or twice a month. This new bill payment system increases activity on the platform and has users visiting more frequently.

Aspora has been testing this feature with a few thousand users for several weeks and has seen positive results. Mobile recharges emerged as a significant use case during this test. Because the Bharat Bill Payment System does not support some categories, like mobile recharges for foreign payers, Aspora has partnered with the international mobile recharge company Ding to facilitate these transactions.

The feature is currently available for customers in the United Kingdom. The company plans to make it available to users in the United States and the United Arab Emirates soon.

In June, Aspora raised fifty million dollars in a Series B funding round at a five hundred million dollar valuation. The round was led by Sequoia, with other investors including Greylock, Hummingbird, Quantum Light Ventures, and Y Combinator. The company has raised more than ninety-nine million dollars in funding to date.

The startup opened its services to non-resident Indians in the United States market in July. The US accounts for the top inward remittance market for India, with nearly twenty-eight percent market share according to the country’s central bank.

Aspora has now reached eight hundred thousand customers. These customers have conducted transactions totaling four billion dollars and have saved twenty-five million dollars in transfer fees, according to the company.

Aspora aims to launch non-resident external accounts and non-resident ordinary accounts next year. These accounts will let users manage foreign income and income earned in India, respectively.