Another day brings another nine-figure investment for a nuclear startup. Radiant Nuclear announced today that it has raised more than three hundred million dollars. This news arrives just one day after Last Energy reported a one hundred million dollar raise. Three weeks ago, X-energy raised seven hundred million dollars, and last August, Aalo Atomics raised one hundred million. Radiant itself had raised one hundred sixty-five million dollars just six months prior.

Given this relentless string of investments, it seems reasonable to ask whether the nuclear industry is in a bubble. Investment in the technology has tracked closely with the data center boom. Artificial intelligence requires tremendous amounts of electricity, and tech companies have been rushing to secure power from sources ranging from nuclear fission to unconventional engines.

As long as the power demands of technology companies continue to grow, interest in nuclear is likely to remain strong. However, a winnowing of the field may occur in the next year or two if startups fail to deliver on their promises, many of which revolve around starting their first reactor next year.

Some companies might buy additional time. First-of-a-kind reactors can be built by hand, but many nuclear startups are predicated on the idea that mass manufacturing will make fission cost-competitive. They might succeed at starting a reaction but stumble when attempting to replicate their designs.

This is not to say Radiant will fall into that category; it may very well succeed. The company simply happens to be the latest in a long list of nuclear startups announcing eye-popping fundraises recently. Anytime a market gets this frothy, questions about a bubble are bound to arise.

The new round was led by Draper Associates and Boost VC, with participation from Ark Venture Fund, Chevron Technology Ventures, Friends & Family Capital, Founders Fund, and others. It values Radiant at over one point eight billion dollars. Previous investors include Andreessen Horowitz, DCVC, Giant Ventures, and Union Square Ventures.

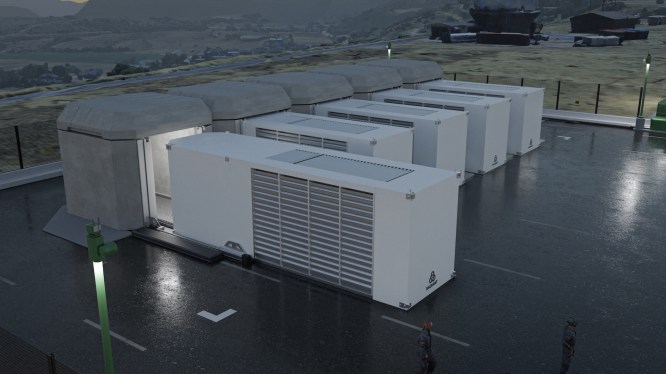

Radiant is developing a microreactor capable of generating one megawatt of electricity that can be delivered by semi-truck. It will be cooled by helium and contain enough TRISO fuel to last five months between refueling. This fuel consists of carbon and ceramic-coated beads of graphite and uranium designed to be more resistant to meltdowns.

The startup aims to replace diesel generators at commercial and military sites. Customers can buy the units outright or subscribe to a power-purchase agreement. When the reactor’s twenty-year lifetime ends, the company will haul it away.

Like many nuclear startups, Radiant is targeting data centers as early customers. The company signed a deal with data center developer Equinix in August to supply twenty of its reactors.

First, Radiant is building a demonstration reactor at the Idaho National Lab, with hopes to begin testing in the summer of 2026. Many nuclear startups are on a similar timeline, one set by a previous administrative goal of three reactors achieving criticality by July 4, 2026. Criticality is the moment when a nuclear reaction becomes self-sustaining. Radiant is one of eleven companies selected for that program, which does not provide government grants but instead speeds approval timelines.