Nvidia founder and CEO Jensen Huang expressed a highly optimistic outlook during the company’s third-quarter earnings report. The company’s financial results provide strong justification for this confidence. Nvidia reported third-quarter revenue of fifty-seven billion dollars, a sixty-two percent increase compared to the same period last year. The company’s net income on a GAAP basis was thirty-two billion dollars, which is sixty-five percent higher year-over-year. Both the revenue and profit figures exceeded Wall Street’s expectations.

The revenue breakdown illustrates a company experiencing a massive boom, primarily driven by its data center operations. Revenue from Nvidia’s data center business reached a record fifty-one point two billion dollars. This represents a twenty-five percent increase from the previous quarter and a sixty-six percent rise from a year ago. The remaining six point eight billion dollars in revenue came from other segments, led by the gaming business at four point two billion dollars, followed by professional visualization and automotive sales.

Nvidia’s Chief Financial Officer, Colette Kress, explained to shareholders that the data center growth is being fueled by an acceleration in computing, powerful AI models, and agentic applications. During the quarterly call, Kress revealed that the company announced AI factory and infrastructure projects in the past quarter that amount to an aggregate of five million GPUs. She stated that this demand spans every market, including cloud service providers, sovereign nations, modern builders, enterprises, and supercomputing centers, and includes multiple landmark build-outs.

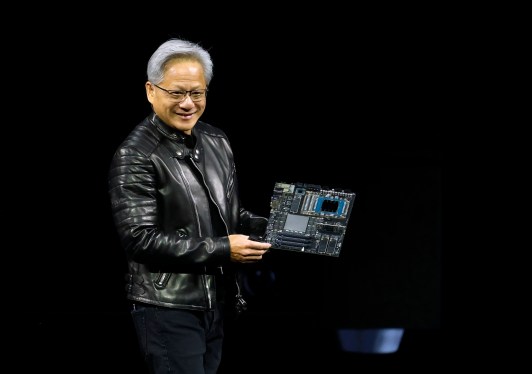

The Blackwell Ultra GPU, which was unveiled in March and is available in several configurations, has been performing particularly well and is now the leading product within the company. Previous versions of the Blackwell architecture also continued to see strong demand according to the company. Huang described sales of the Blackwell GPU chips as being off the charts. He also noted that cloud GPUs are sold out and that compute demand keeps accelerating and compounding across both training and inference, with each growing exponentially. Huang stated that the company has entered a virtuous cycle of AI, with the ecosystem scaling fast across more industries and countries.

However, Kress did note a disappointment in the company’s shipments of the H20, a data center GPU designed for generative AI and high-performance computing. Shipments were fifty million, a result that fell short of expectations due to an inability to sell effectively to China. Kress explained that sizable purchase orders never materialized in the quarter because of geopolitical issues and an increasingly competitive market in China. While disappointed by the current restrictions, she affirmed the company’s commitment to engaging with both the U.S. and Chinese governments and advocating for America’s ability to compete globally.

Looking ahead, Nvidia is forecasting continued growth with a projected fourth-quarter revenue of sixty-five billion dollars. This positive outlook helped push the company’s share price up more than four percent in after-hours trading. The overall conclusion, from Huang’s perspective, is to dismiss talk of an AI bubble. He stated that from Nvidia’s vantage point, they see something very different, implying sustained and substantial growth.