Nick Pompa is the founder of Lootlock, an app designed to prevent children from making unauthorized gaming purchases on their parents’ credit cards. He is an avid gamer and a software developer working in fintech. As a father of two young children, he looks forward to sharing his passion for gaming with them when they are older. He began gaming at the age of six.

Lootlock was chosen for TechCrunch’s 2025 Startup Battlefield 200 and will be exhibiting at TechCrunch Disrupt from October 27 to 29 in San Francisco.

In conversations with other parents and through news reports, Pompa repeatedly encountered horror stories of children accidentally charging large sums to their parents’ credit cards. These surprise bills sometimes amounted to thousands of dollars. The gaming industry has a notorious reputation for using design tricks to target children, enticing them to unlock features that incur fees. This practice has been highlighted by the Consumer Financial Protection Bureau and similar warnings have been issued by the FTC.

Pompa explained that the gaming industry uses clever design, social engineering, and player tracking to encourage kids to spend more money. As an avid gamer himself, he has witnessed the industry’s significant shift toward micro-transactions over the last eight to nine years. Although the FTC recently forced Fortnite to issue refunds totaling 126 million dollars, such outcomes are rare. Typically, parents have no recourse and are forced to pay the bills.

Common advice suggests that parents use device-level controls to block in-app purchases. However, many parents are comfortable allowing their children to spend a limited amount of money under the right conditions.

The inspiration for Lootlock came from a friend named Joe, a father of three avid gamers. Joe gave his children a monthly allowance, which they used to buy gaming products. This created an inefficient system where he handed them cash, only for them to return it to pay the credit card bill, requiring him to closely monitor all their purchases.

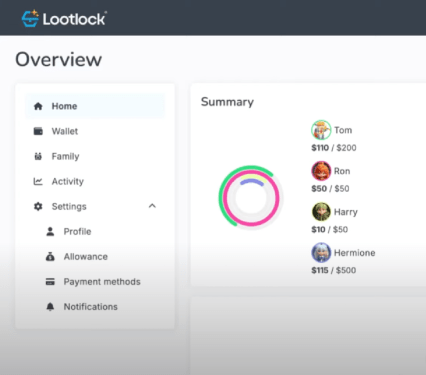

Lootlock addresses this by allowing parents to automatically load a digital, prepaid credit card, issued in partnership with Transcard, which children can add to their device’s digital wallet. Parents can set a weekly or monthly allowance and choose to lock a portion of it. Children can then unlock more funds by completing tasks like chores, with parents able to approve increases via text message.

The app gives parents detailed control over how and when their children can spend. An upcoming feature called “bounty boards” will gamify chores. Parents create lists of chores, and as children complete them, they earn a bounty. Upon reaching a parent-defined threshold, the app unlocks additional allowance.

Lootlock also includes a gamified financial education component. Children choose an avatar and earn points for practicing good spending habits, such as checking their account balance on the Lootlock dashboard. These points can be used to acquire equipment for their avatar, like swords and armor. This avatar remains consistent across platforms where Lootlock is integrated, such as its Discord servers.

The app ties financial concepts into video game ideas. Importantly, Lootlock balances can only be spent on gaming products and not on other online purchases. This allows parents to avoid closely monitoring their children’s online spending. The current goal is to teach children responsible gaming habits.

The startup currently employs seven people and is fully bootstrapped.