Lidar manufacturer Ouster has acquired StereoLabs, a company that makes vision-based perception systems for robotics and industrial applications. The deal is valued at a combination of thirty-five million dollars and 1.8 million shares of Ouster stock.

This acquisition is the latest move in a trend of consolidation among perception sensor suppliers. Just last month, MicroVision purchased the lidar assets of the now-bankrupt Luminar for thirty-three million dollars. Ouster itself is no stranger to mergers and acquisitions, having merged with rival Velodyne in 2022 and acquiring lidar startup Sense Photonics the year before.

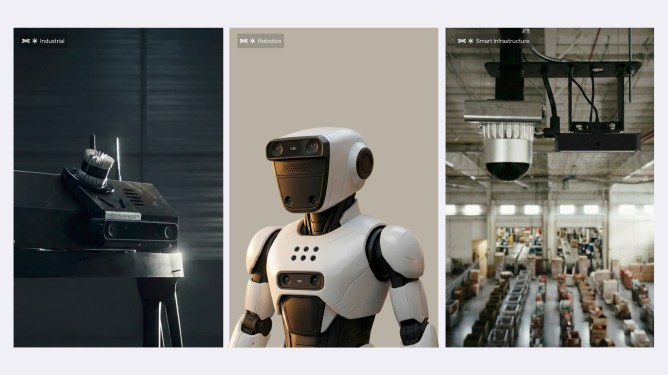

This industry consolidation is occurring as companies and investors rush to build businesses around “physical AI.” This broad term encompasses everything from humanoid robots and drones to self-driving cars and automated warehouse systems. The growing interest has led to significant funding rounds for even obscure suppliers, with some startups attempting to develop entirely new sensor modalities.

Ouster co-founder and CEO Angus Pacala stated he had been interested in StereoLabs for years. He sees lidar as a core component for safety-critical systems but wanted to expand the company’s capabilities. Pacala explained that cameras are the obvious additional sensor to integrate with lidar. He praised StereoLabs as best in class on hardware and was particularly impressed by the company’s savvy use of cutting-edge AI models and edge computing to maximize camera performance.

Pacala highlighted StereoLabs’ development of a foundational AI model that can determine object depth from stereo cameras. He described the acquisition as a natural step, pitching a vision of a unified sensing and perception platform to become a tier-one supplier for advanced physical AI systems.

Despite the focus on integration, Ouster confirmed that StereoLabs will operate as a wholly owned subsidiary. Pacala also offered a tempered perspective on the current physical AI hype cycle. He emphasized that the business model is not about selling fervor but about creating certified, safe systems that solve real customer problems. He predicted some disillusionment, especially around humanoid robotics, as the time to market for such technologies proves longer than some expect.

Pacala is not alone in this realistic view. In a recent interview, MicroVision CEO Glen DeVos stated the sensor industry is ripe for consolidation, believing there is not enough revenue to support all current competitors. He predicted further consolidation or a weeding out of companies that cannot survive.