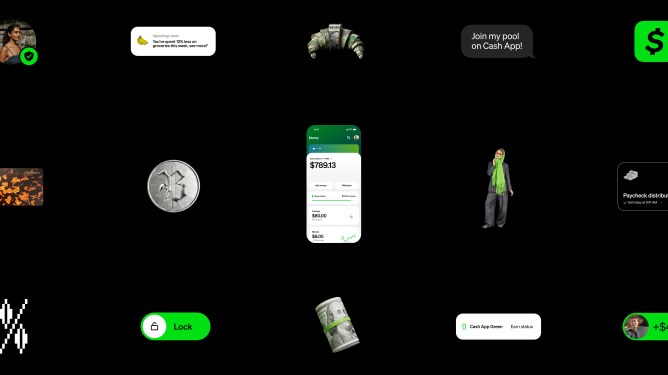

Cash App has introduced a range of new features in its fall update. These include an AI chatbot for financial questions, a new benefits program, and the ability to find and pay with Bitcoin using US dollars.

The company is launching an assistant called Moneybot. This tool can answer questions about spending habits and income. It also provides insights for saving money and setting aside funds for investments. The chatbot will first be available to a limited group of users, with plans to expand access in the coming months. Users can ask questions such as, “Can you show me my monthly income, expenses, and spending patterns?” to receive account reports. The bot also suggests actions like splitting a bill, checking a Bitcoin balance, or requesting money from someone.

A company executive stated that Moneybot goes beyond just showing data by helping users turn financial insights into action. The tool is designed to learn individual customer habits and tailor its suggestions in real time.

Block, the parent company of Cash App, continues to develop new ways to promote Bitcoin payments. Customers can now discover places that accept Bitcoin through a new map feature. They can also pay in cryptocurrency using US dollars without needing to hold Bitcoin themselves. The company uses the Lightning Network to facilitate these transactions via QR codes. Block also announced that it will soon allow some customers to send and receive stablecoins through the app.

The benefits structure for Cash App customers is also changing. The company is starting a new program called Cash App Green. Users can qualify for benefits by either spending $500 or more per month through the Cash App Card or Cash App Pay, or by receiving direct deposits of at least $300 per month.

These new benefits include a higher borrowing limit, free overdraft coverage for Cash App Card transactions, free in-network ATM withdrawals, an annual percentage yield of up to 3.5% on savings, and five customized weekly offers at stores. Block estimates this new program will make up to 8 million accounts eligible for benefits.

The company is also offering a 3.5% annual percentage yield for teen accounts with no balance limits. Other new features include the expansion of the Cash App Borrow product to 48 states. Customers will also gain access to some Afterpay buy now pay later services and features directly within the Cash App without a separate login.